Case Study: ESG Due Diligence Review

Engagement Overview

Fulcrum Consulting Group was engaged by a Private Equity client to assess ESG risks and opportunities for one of their portfolio companies, a U.S. manufacturing business. Fulcrum worked with management to locate and analyze available internal company data on issues deemed to have the potential to materially impact financial value.

Client

Private Equity

Engagement

ESG Due Diligence Review

Industry

Manufacturing

Key Issues

-

ESG due diligence is the process of evaluating how effective a company is at recognizing and addressing ESG issues within its strategic context.

-

In addition to preserving economic value by reducing idiosyncratic risk, successful management of ESG factors drives value creation by unlocking reputational benefits, reducing borrowing costs, improving employee engagement and, ultimately, superior top and bottom-line growth.

-

Resources are finite and management teams and investors can only manage what is measured. ESG due diligence reviews amplify strategic decision making by giving focus to the areas with highest potential for economic impact post-close.

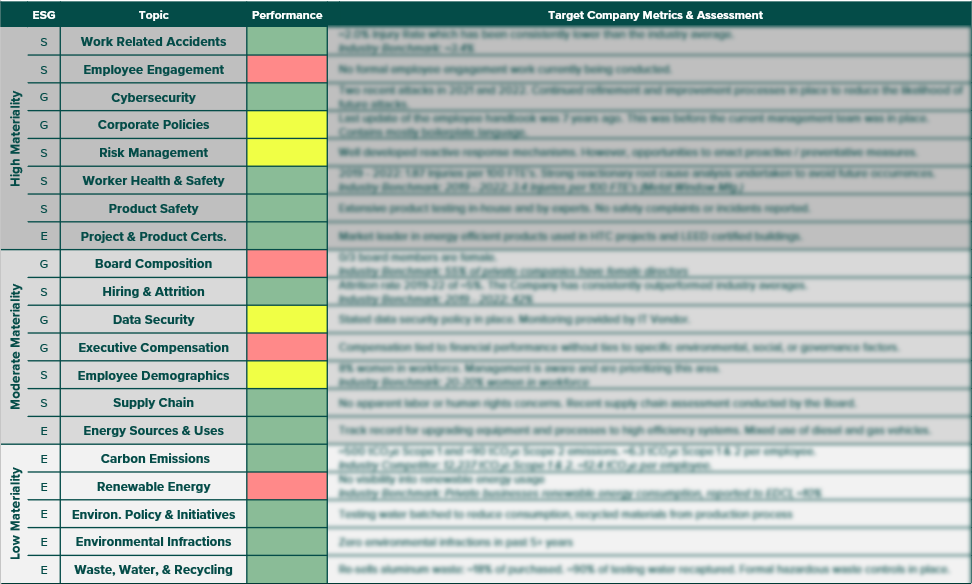

Fulcrum delivered a rigorous assessment of ESG related risks and opportunities for the target company. Relevant internal company data was located and performance was interpreted within the context of industry benchmarks that Fulcrum developed using publicly available secondary data.

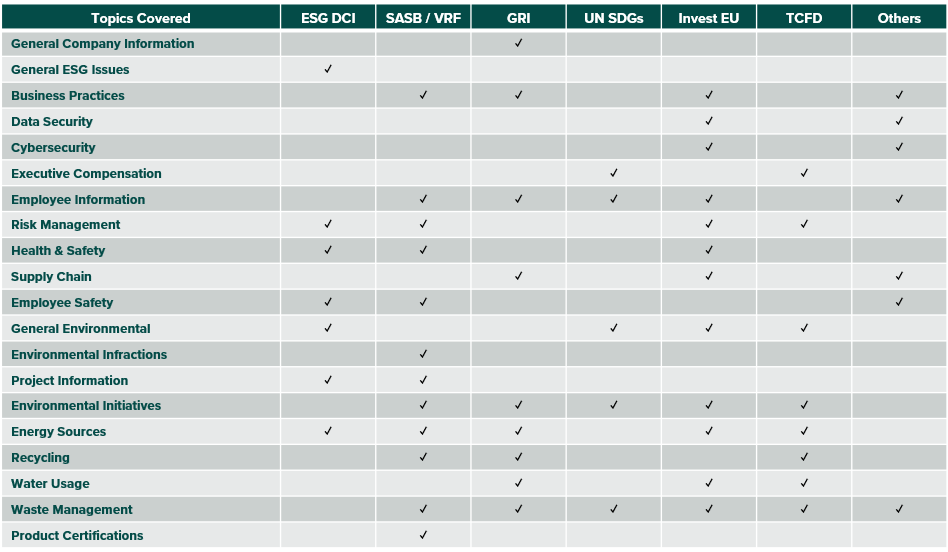

When engaged to conduct an ESG due diligence review, Fulcrum’s team quickly produces a highly customized questionnaire tailored to the business at hand. As part of the process, Fulcrum contemplates a wide range of leading sustainability frameworks including the ESG Data Convergence Initiative, SASB, GRI, the Sustainable Development Goals, TCFD and others.

Approach

Interviews with Management: Fulcrum’s team spent time gathering information and data from key team members including the CEO, Technical Director, Plant Manager, and Controller. Effective ESG diagnostics require a detailed understanding of a company’s policies, practices, and norms. Most business leaders are already doing a lot to manage key risks (e.g., workplace injuries). Our insight characterizes these strengths, weaknesses and opportunities, in addition to uncovering threats.

Document Review: Many metrics are attainable from readily available company sources. Fulcrum reviews employee handbooks, training protocols, utility bills, vendor spend reports, data security policies, and other relevant data sets provided by the company.

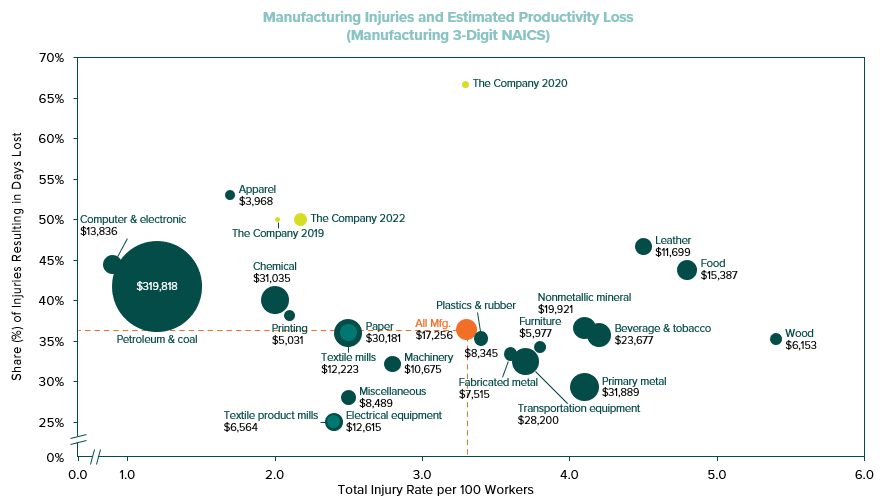

Secondary (desktop) Research: Once Fulcrum has a clear sense for the data that exists within the company, attention turns to evaluating performance relative to industry peers. It is critical understand the company’s operating context. Fulcrum develops several benchmarks for consideration. In the case of manufacturing businesses, workplace injuries are always a relevant consideration.

Impact

Fulcrum Consulting Group’s trained sustainability professionals are skilled at helping business leaders measure what matters. Fulcrum’s work pinpointed priority areas for focus to reduce risk and issued a dozen actionable recommendations to integrate into value creation planning.

When it comes to preserving and promoting financial value, work with a partner that can give your management team a clear sense for which metrics matter and how to measure them.