NYU Stern CSB’s Value Framework Tool

Fulcrum Consulting Group Perspective

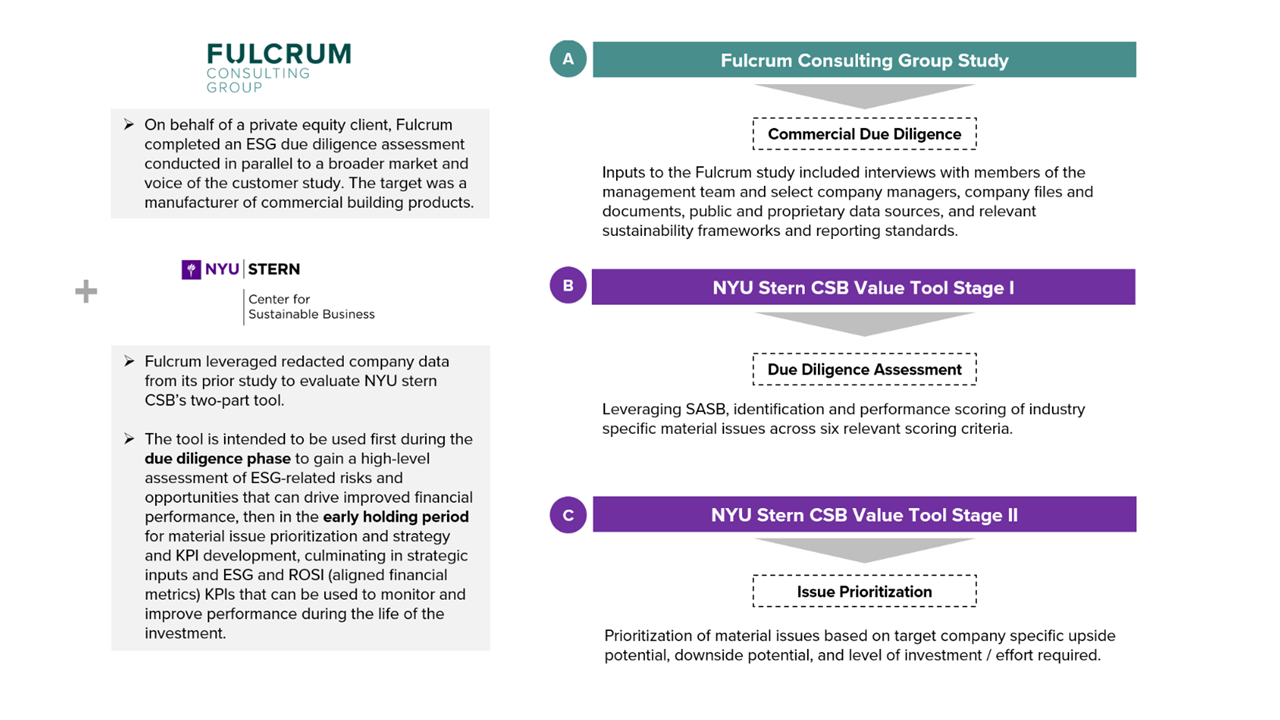

Over the course of 2024, Fulcrum Consulting Group partnered with NYU Stern’s Center for Sustainable Business (CSB) to provide coaching programs for several industry leading Private Equity GPs interested in exploring CSB’s new sustainable strategy prioritization and value driver tool.

Background

NYU Stern’s Center for Sustainable Business (CSB) offers private equity investors a practical new tool with their Strategy Prioritization & Value Driver Framework. By targeting multiple points of the investment cycle and aligning with ESG Data Convergence Initiative (EDCI) metrics, CSB’s framework tool demonstrates a keen understanding for the unique challenges and opportunities facing private market participants. The two-stage value framework tool provides an open-sourced structure that is well-organized and easy to use, with ample instruction provided. It is designed to help its users maintain focus on the issues that have the greatest potential to move the needle on financial value creation.

CSB’s tool comes at a time when leading practitioners are focused on evolving their sustainability related environmental, social, and governance (ESG) efforts from risk mitigation (important but hard to measure) to enterprise value creation. A sense of urgency is understandable given recent political pressure and disparate interpretations of what ‘sustainability’ or ‘ESG’ means for fiduciaries. For private equity investors, value creation requires greater coordination between commercial due diligence (CDD) and ESG due diligence activities. Effort is wasted and opportunities are missed when ESG data is interpreted without direct insight into a target company’s market dynamics, the voice of its customer stakeholders, and its competitive positioning. By explicitly categorizing upside value creation opportunities, CSB’s new tool is aligned with this shift.

Process

The tool is intended to be used first during due diligence to gain a high-level assessment of ESG-related risks and opportunities. Then, following investment, the tool allows for strategic issue prioritization and KPI development during the holding period to monitor and improve financial performance. Leveraging redacted ESG data from a prior commercial due diligence engagement for a private equity client, Fulcrum evaluated Stern’s two-stage GP assessment and strategy framework tool. The target was a manufacturer of commercial building products.

When engaged to provide an ESG due diligence assessment, Fulcrum begins by developing a custom due diligence questionnaire (DDQ) tailored to the financially material and decision useful issues facing a target company. Fulcrum considers and harmonizes redundancies from the alphabet soup of leading sustainability reporting frameworks and standards (e.g., SASB, GRI, EDCI, UN SDGs, PMDR, etc.) to develop a rigorous yet manageable issue set that streamlines the process and eliminates unnecessary effort by company management. After analyzing data and comparing key metrics against custom benchmarks, Fulcrum delivers strategic recommendations designed to maximize financial value creation and risk mitigation objectives.

Stage 1: Due Diligence Performance Assessment

Stage I allows the user to quickly assess performance across material topics identified by SASB, which auto-populate throughout the tool. The user scores the target company’s current performance across six specific criteria. Performance scoring requires some data collection; however, even a qualitative understanding of major incidents combined with a working understanding of company policies, practices, and norms allows for a reasonable starting point. Importantly, the framework tool provides a detailed rubric to inform scoring choices.

NYU Stern CSB

Stage 2: Issue Prioritization & Value Creation

Stage II supports value creation efforts by providing industry specific recommendations and relevant KPIs. Functionality is focused on helping the user prioritize relevant value drivers based on company specific upside (opportunity) and downside (risk) scores. Scores should reflect both absolute risk / value creation potential as well as likelihood of impact based on the Company’s current practices and market position. The investment / effort required for successful execution is also factored into prioritization, a necessary and pragmatic lens. More robust data collection and analysis is required during this stage.

NYU Stern CSB

With data in hand, the auto-populated outputs yield a manageable set of KPIs and strategic decision-making prompts to consider within the context of the specific business case. The strategic recommendations and financial metrics provided align broadly with leading reporting frameworks and ROSI (Return on Sustainability Investment) metrics. Outputs can therefore fuel further analysis (e.g., materiality assessments), value creation planning, and serve the unique reporting needs of the user’s sustainability program and investment mandate.

NYU Stern CSB, FCG Research & Analysis

The strengths of the framework tool are significantly amplified by access to high-quality company data. Therefore, performance assessments and strategic planning priorities should be revisited over time and with the inclusion of new information and operating context.

Key Findings

During the holding period, where private equity investors have ownership control and access to significantly more data, the challenge becomes one of prioritization. Resources are finite. Therefore, efforts must be focused on the opportunities that have the greatest potential to unlock financial value. Graphical outputs in Stage II of the framework tool (examples below) provide helpful visualizations to guide prioritization efforts. The tool’s visualizations encourage discussion, refinement of prior analyses, and ultimately support strategic decision making.

With data in hand from Fulcrum’s commercial due diligence engagement, both stages of the tool were easy to populate, and the tool’s outputs accurately highlighted several key findings from the original study. Two notable examples are discussed and depicted below, using the tool’s Issue Prioritization charts.

NYU Stern CSB, FCG Research & Analysis

High Priority: Product Design & Lifecycle Management

Significant Upside Value Creation Opportunity + Minimal Investment = High Priority

During customer interviews completed in support of Fulcrum’s commercial due diligence mandate, a customer with relatively small revenue contribution shared that they did not send RFQs to the target company for projects where energy efficiency was important, most notably, large, LEED certified projects on university campuses. The customer was unaware that the target company carried a product with superior energy efficiency ratings than competitor offerings. Armed with a detailed understanding of the product energy efficiency ratings due to the ESG work, the Fulcrum team recognized a performance-perception mismatch and notified the client. In the target company’s largest market segment, efficiency was not a top purchase criterion and therefore sales reps seldom discussed this competitive advantage with customers. The market size of the high efficiency segment was relatively small, but the market share gain opportunity was material. Having already developed a more competitive product, execution effort simply required more strategic marketing communication with customers in segments where efficiency was a key selection driver.

High Priority: Employee Health & Safety Management

Significant Risk Mitigation Potential + Minimal Investment = High Priority

During due diligence, Fulcrum developed workplace injury benchmarks to compare the manufacturer’s performance against comparable manufacturing businesses. Workplace injuries are associated with multiple direct and indirect financial impacts, including loss of human capital, production down-time and overtime costs, increased hiring costs, potential litigation, OSHA fines, etc. Analysis revealed that the Company outperformed the average industry participant in recent years, as measured by its total recordable incident rate (TRIR). This was consistent with a review of safety policies, practices, and norms which demonstrated a strong safety-oriented culture at the Company. However, when injuries did occur, they resulted in above average productivity losses as measured by days lost, a proxy for injury severity. Notably, data revealed an increasing injury severity trend over the prior 3 years. Conversations with management revealed that the Company previously hosted regularly scheduled safety briefings on-site facilitated by a third-party staffing partner. Third party safety briefings ceased during the COVID-19 pandemic. Given the relatively low cost to reinstate regularly scheduled safety trainings, among other practical and low-cost safety investments, CSB’s framework tool correctly prioritizes employee health and safety as an area with potential for quick wins.

Applied Learnings for Private Equity Investors

Embedding ESG due diligence within more traditional commercial due diligence activities amplifies value creation results while saving time and resources.

For investors looking to sharpen their focus on the connections between financial and sustainability issues, the Stern CSB value framework tool provides a valuable starting point and a clear path toward improved strategic decision-making.